The Easy Way to Fax Online

Send and receive faxes from anywhere using your computer, tablet or smartphone.

Now offering HIPAA compliant plans for regulated industries.

More Than Just Faxing

eFax allows you to easily download files from popular cloud storage services like Dropbox, iCloud and Google Drive so you can quickly grab files from the cloud, attach them to your virtual fax, and send online faxes.

Choose from two convenient signing options for your electronic faxes: sign your faxes online by swiping your finger across the screen of your mobile device, or simply drag and drop a “saved” signature onto your fax document.

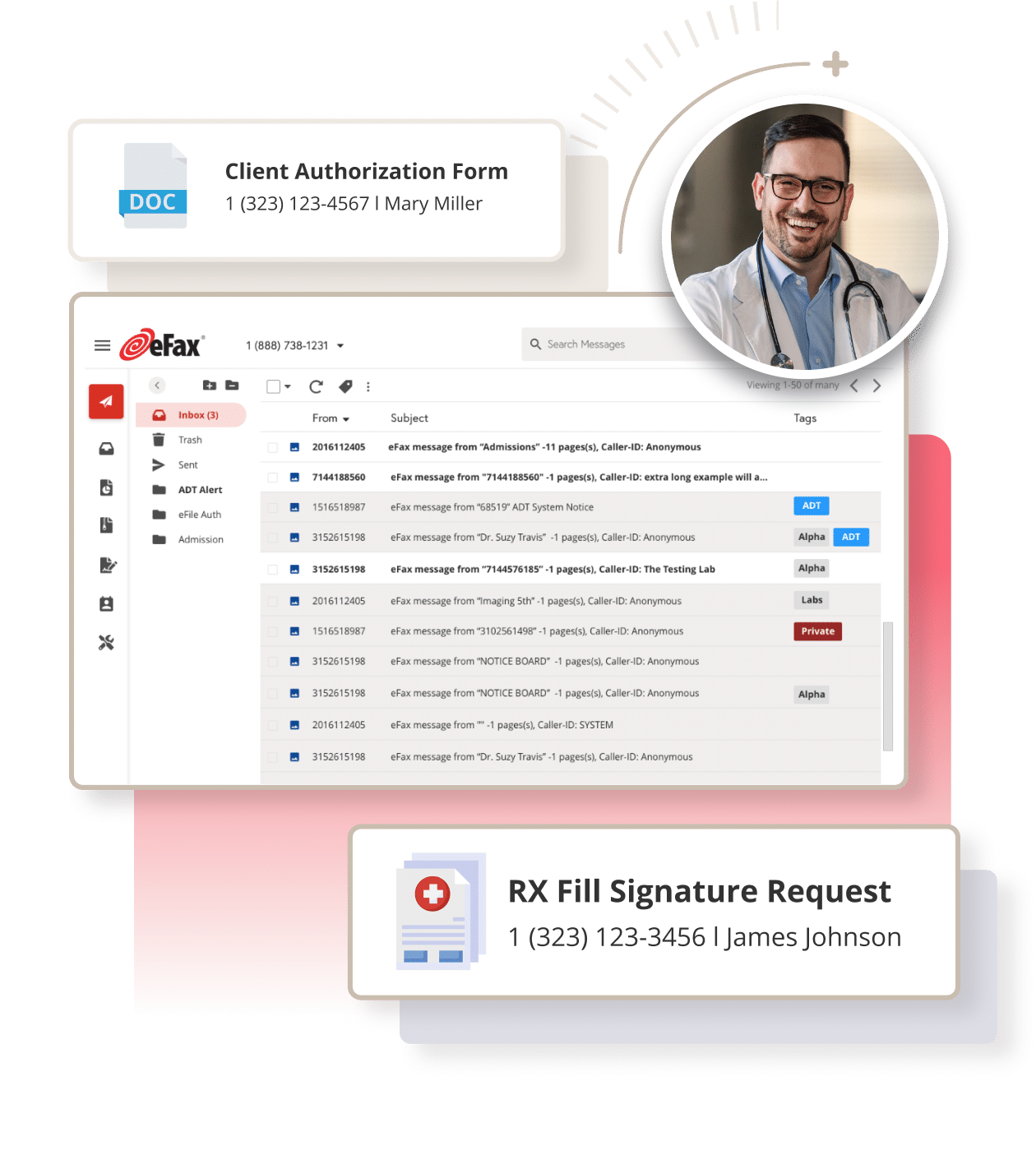

Securely store and easily access all inbound and outbound faxes online for the life of your account. Tag your faxes with keywords for easier search and retrieval.

Unleash the power of compliant fax. eFax Protect, our highly encrypted online fax solution enhances the security of your fax communications and maintains compliance with applicable requirements under HIPAA, GLBA and SOX regulations.

Now you can be more efficient, fax online from anywhere, and close deals on the go. Tap on the app to receive, sign and send online faxes right from your phone or tablet.

Secure and HIPAA-Compliant Faxing

Achieve HIPAA compliance in regulated industries with eFax Protect or eFax Corporate HITRUST certified enterprise fax solutions. Our AES secure transmission maintains adherence to HIPAA, SOX, GLBA, and PCI regulations, backed by 256-bit TLS encryption and Tier-3 secure servers. eFax is the trusted choice for individuals and businesses seeking secure and compliant faxing solutions.

- Security and compliant for healthcare and other regulated industry sectors

- AES 256-bit encryption for data security

- ISO 27001 certified eFax for business corporate fax solutions

- Access faxes securely via MyPortal, Messenger app, or mobile app

- Enjoy searchable PDFs for streamlined document management

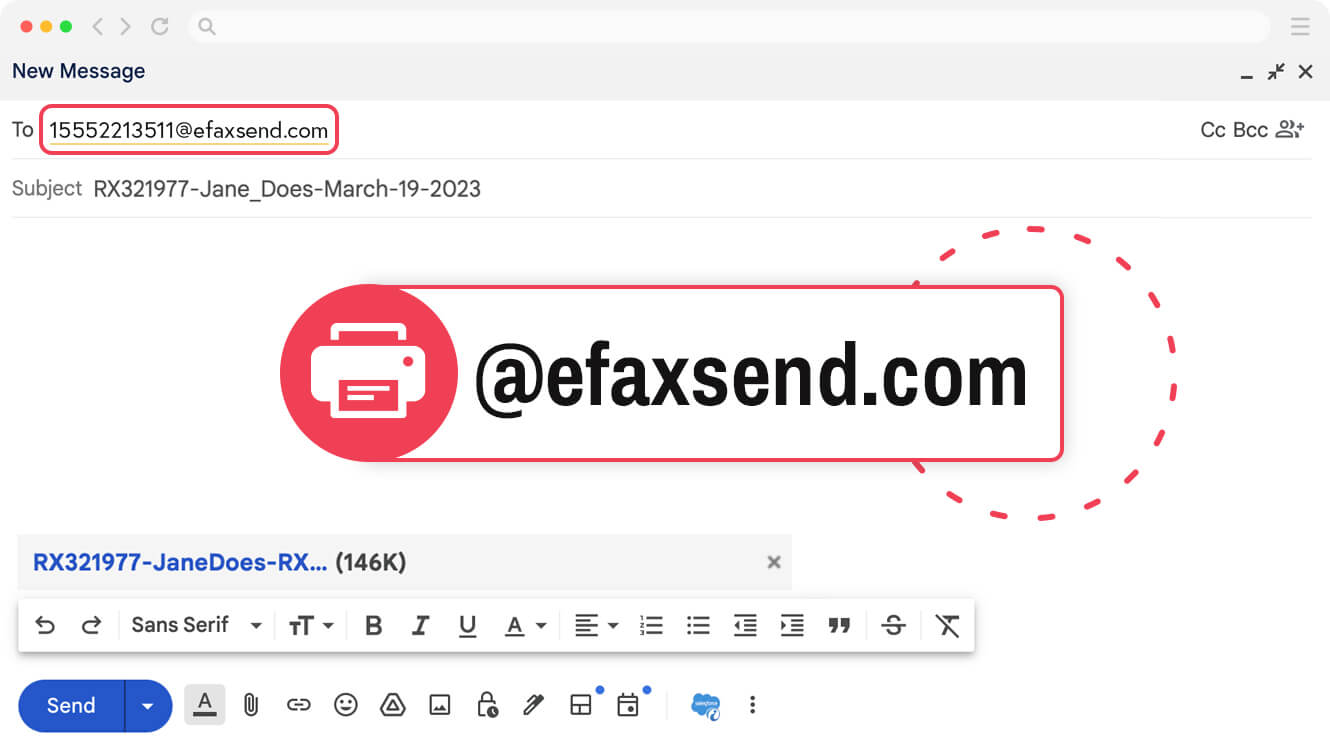

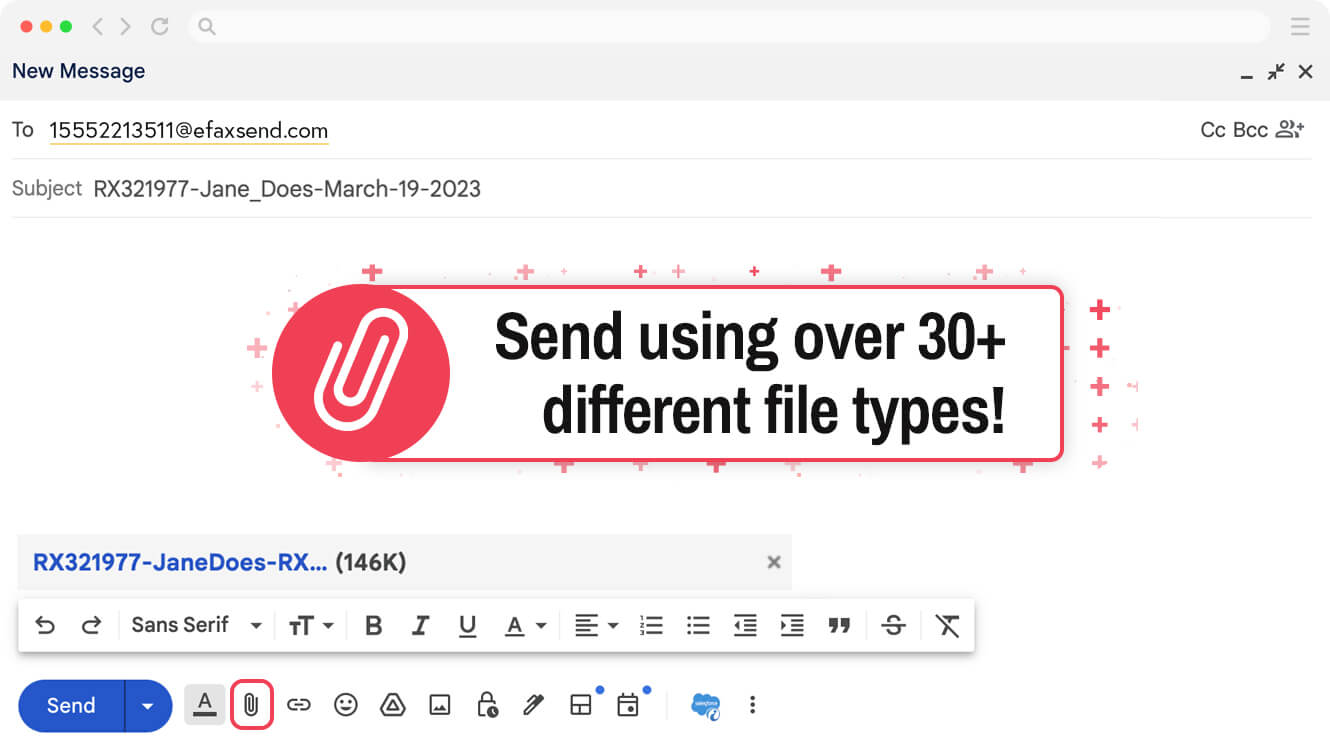

How to Fax Online with eFax in 3 Easy Steps

If you can send an email, you can fax with eFax.

To receive faxes with eFax, just check your email inbox. Incoming faxes will be delivered there as PDF attachments. You can also send an online fax using the eFax web portal or our convenient mobile app.

Receive Faxes Online, by Email or Mobile App

Receiving faxes online, by email, or through a mobile app with eFax offers numerous benefits including convenience, flexibility, efficiency & accessibility.

Start for Only $5The eFax Platform

A solution to scale with your business

Send a Fax From Anywhere > Safe Processing > Robust Integration > Receive Faxes Electronically

Protection

eFax protects your documents with advanced encryption and privacy measures. Rest easy knowing your data is safe wherever it goes.

Cost Value

Maximize cost savings without compromising on quality. eFax provides outstanding value with an affordable monetary investment.

Compliance

Select from certain service solutions that utilize features that are consistent with applicable regulations. Send and receive sensitive documents safely with our trusted electronic faxing service.

Reliability

Get prompt, reliable fax delivery with instant online access.

Interoperability

Seamlessly integrate eFax with your existing communication systems. Add cloud faxing capabilities to your existing online workflow.

Customer Services

Receive dedicated support from a personal account manager. Get help with our system any time via 24/7 technical customer assistance.

Integrate eFax with the Apps & Services You Already Use

Integrates with third party solutions to optimize your workflows and enhance productivity. Experience smooth document exchange and automated tedious processes.

Trusted by Industry Leaders

Discover why eFax is the preferred choice of clients and trusted partners spanning diverse industries. Our reliability and commitment to excellence make us a top-notch fax solution.

See Our ReviewsConnect Globally

Send faxes online globally from 46 countries with ease

Fax worldwide from 46 countries and 3,500 cities with eFax. Our online fax service simplifies international faxing, allowing effortless use of dialing codes. Access local fax numbers and toll-free fax numbers in these regions from our extensive database.

Scalable Solutions

Send and Receive Faxes in Minutes

Related FAQs

Can I send a fax online?

eFax provides a host of convenient ways to send a fax online: via email, with the mobile app, or using your online account on the eFax website. eFax works with all major computer files, including PDF, TIFF, DOC, and PNG.

How do I get started with eFax?

Getting started with your new eFax account is easy. There’s no special equipment to buy. Our innovative online fax service offers key features to help you accomplish essential tasks for your business. Sign up today to get started.

How secure is faxing over the internet?

Online faxing, particularly with platforms like eFax, is highly secure. eFax employs robust encryption measures to ensure the confidentiality and security of transmitted documents. Furthermore, strict access controls, including two-factor authentication, are in place to limit access to unauthorized users.

Why is eFax the best online fax service?

Millions of users rely on eFax for their digital faxing needs, drawn by our two-decade legacy as the world’s leading online fax service. Our reputation is solidified through the trust of Fortune 500 corporations and thriving small businesses globally. eFax facilitates efficient online faxing and provides HIPAA-compliant plans tailored to regulated industries.